The impact of Covid-19 on Super Funds

The COVID-19 has delivered an enormous economic shock worldwide and has led to the deepest contraction in the global GDP in recent decades. According to the World Bank Report, the global economy will shrink by around 5.2% this year, affecting the emerging and developing economies the most.

Australia’s economy is also showing signs of severe stress. With its March quarter GDP numbers coming in at negative 0.3%, the first contraction in 29 years. It is expected that the economy will contract further by 6.7% this year, which would make it one of the worst-performing economies in the Asian region.

For the superannuation industry, the experience is much similar to the economic downturns in the early 1990 and the global financial crisis in 2008. The investors then had to suffer from huge losses on their super balances. Many had to postpone their retirement, cut back on spending in a bid to make up for the losses. Its impact is still felt across.

The Risks Surrounding the Super Funds

The financial year 2019-20 was characterised by extreme volatility in the market. In the first half of the year, the super funds charged ahead on the back of booming markets before falling into deep losses due to the COVID-19 induced economic shock.

Between the period February 20 and March 23, the stock market crashed 36% from its peak. The median growth fund plunged 12.5% and median balanced funds fell 8.9% during that period. For a person nearing his/her end of working life, the crash is a huge financial shock, taking away tens of thousands of dollars from the super fund in just a few weeks.

Although the market rebounded and super funds were able to cut down on losses by the end of the financial year 2019-20, the long term risks remain.

The rebound in the market was mainly due to the unprecedented level of liquidity pumped in by the central banks from all over the world. In the short term, the prices of the assets will continue to go up despite the negative economic outlook. A very short term measure to support the falling economy, but creates a new risk in the system in the long term. With the lack of synchronization of the financial market with the underlying economic reality, the volatility will continue to exist and once the market loses confidence, the value of investment asset will correct itself eventually. Further, depreciation in the Australian Dollar is making the long term outlook little unclear.

The response of Federal Government to Super Funds in Wake of Covid-19

Through the Coronavirus Economic Response Package Omnibus Bill 2020, the government has temporarily relaxed the rules relating to the early release of funds, reduced the drawdown limits and deeming rates for social security payments.

Temporary Early Release Scheme on Compassionate Ground

The amendments made to the SIS Regulations allowed members to withdraw up to $20,000 from their superannuation savings in two instalments as tax-free lump sums, $10,000 in the 2019-20 and $10,000 in 2020-21.

As on 9th August 2020, using this relief window, almost 3 million members have withdrawn $31.1 billion with an average payment of $7,689.

The Impact

The move has been severely criticized by industry insiders. Although a short term relief to members, it will have a significant impact on the future superannuation balances. Due to the early release of superannuation, members will miss the benefits of compounding on withdrawn balance.

According to an ASFA modelling, a 30-year-old withdrawing $10,000 will lose as much as $21,500 in today’s dollar term at the retirement. And, if accessed the second ERS payment, the total loss would be at $43,032 at the retirement.

For funds also, they have to hold more in cash balance to meet the withdrawal request. And, the cost is more for the funds having a higher share of illiquid asset investments.

Kirstin Hunter, co-founder at Future Super said:

“The long-term impact of this scheme will be felt for years to come. Superannuation was never intended to be a national relief fund. Australians should not have to dip into their life savings to get through a public health crisis.”

Reduction in Drawdown Rates for Account-based Pensions

On account of capital loss in superannuation saving funds and to quickly recoup from the losses, the Act has reduced the minimum payments by 50% for the remaining 2019-20 and 2020-21 financial year. Thus, allowing retirees or the pensioners to keep more money in the super funds and take advantage of the market recovery.

Similar drawdown limits were also placed during the global financial crisis in 2008-09.

Reduction in Social Security Deeming Rates

From May 1st, 2020, the upper deeming rate on social security payments is set at 2.25% and the lower rate is at 0.25%. The reductions are made in order to reflect the low-interest rate and its impact on the savings.

The Impact on Contribution to Superannuation Fund

In the June 2020 quarter, the superannuation entities witnessed lower contributions from its members due to a range of interconnected factors that includes:

- The rise in unemployment across sectors and reduced pay

- Members shifting to risk-free return options or defensive investment options

During the June 2020 quarter, total contribution into supers was at $33.6 billion, which is 1.4% lower compared to June 2019 quarter. And, personal contributions for the quarter were at $7.8 billion which is lowest since June 2016.

Total benefits payments during the quarter were $37.4 billion, an increase of 77.7% from the last quarter. The spike has resulted in a negative quarterly net contribution flow of -$2.3 billion for the first time since compulsory superannuation was introduced.

Effects of Financial Crisis on Super Funds

Compared to the impact of the economic crisis of early 1990 and the global financial crisis in 2008-09, the 2020 crisis is very different. It’s hard to draw a parallel line, how the funds are affected during both the period.

Following the collapse of Lehman Brothers in September 2008, which led to the global financial crisis, investors around the world had a very tough time as liquidity sucked out of the market instantly, imposing freezes on huge redemption requests, fund managers going insolvent, and widespread financial distress.

However, compared to the 2008 crisis, Central Banks this time were quick to intervene to support the falling economy, households, revive the consumption-demand cycle, and prevent the financial market from collapse.

The Short-term Impact

With support from central banks, the global market rebounded strongly in the April to July period, which helped super funds to recover from deep losses.

In the Balanced and Growth investment options, where the majority of the growth assets (in range of 50-60%) are deployed in Australian and Global stocks (pre-dominantly the US), the funds are well placed to capture the upside momentum from here.

But, what will be the big drag on the returns is the investment in unlisted assets (unlisted property, unlisted infrastructure, and private equity). For example, the not-for-profit funds have a higher allocation to unlisted assets- about 21% on average.

In the financial year 2019/20, the Australian unlisted property only lost 2.1%, but within the unlisted property market, the retail sector was much worse than the commercial sector, with valuation typically down by 15-20%.

These unlisted assets are well suited for achieving diversification but generates illiquidity premium compared to the listed assets. And, to reflect the true value of these unlisted assets on the fund’s portfolio, funds have devalued their unlisted assets over the course of COVID-19. Thus, making the short-term comparison of funds more complicated and difficult.

The Long-Term Impact

At this very stage, how long the uncertain times will last and how much time it will take for full economic recovery, it’s very difficult to ascertain. But, such uncertain times create a huge opportunity for wealth creation. The returns you see today in growth and balanced supers would not have come if not invested during bad times.

Australian Super tells its members to expect 5 negative years out of 20 years of the investment cycle. In fact, during the 2008 financial crisis, Australian Super’s Balanced Fund lost 13.4% that year, but after that, it provided 10 consecutive years of gains, and 7 of them were double-digit growth. The fund since its inception has returned 9.68% annualised growth despite multiple economic crises.

Since the introduction of compulsory Super in 1992, most growth funds have beaten the inflation by a comfortable margin of 3-4%. Over the last 28 years, the annualised returns of growth fund have been around 8% and the annual CPI increase is 2.4%. The real rate of return from the growth fund is 5.6% per annum. This is achieved despite three major downturns in the market. If we look at the returns category of all funds, from Conservative to All Growth fund, over 3 years, 5 years, 7 years and 10 years, it has met the long term return objectives. For Conservative funds, it is around CPI + 2% and All Growth fund; it is CPI + 4.5%.

Mano Mohankumar, Senior Investment Manager of Chant West says:

“Over the longest period, we can measure Australia’s major super funds have delivered on their promises to members, growing their wealth in real terms while protecting them from undue risk. That’s a great achievement, and it’s an important message their members should be aware of, too.”

Therefore, any comparison of any super fund has to be done over the long term, as supers are ultra-long term investment product.

LifeCycle Products Cruising on the Expected Lines

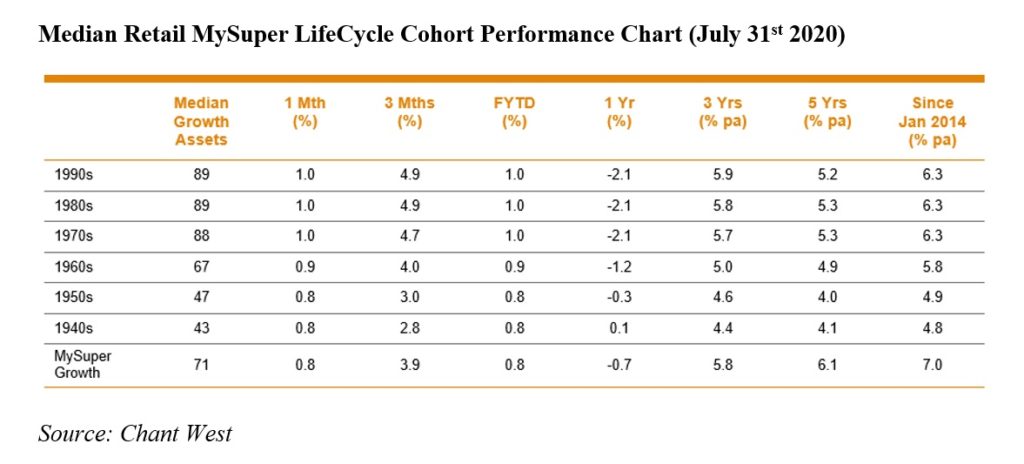

With a significant number of Australians are now pouring their savings in the LifeCycle products, where the member is allocated to age-based options and are progressively de-risked as the cohort gets older.

The idea of LifeCycle product is to capture the benefits of the volatile asset class in the initial phase of the life and gradually switching to the defensive asset class to minimise the risk of volatility and protect the capital when you are near to retirement. Most of the retail funds have adopted the approach of lifecycle strategy for MySuper defaults.

Younger groups, those born after the 1970s which are under higher allocations to growth assets have taken a quite significant hit on their super savings over the past year. But, in the longer period, they have performed exceptionally well. However, the lifecycle products have failed to match the returns of growth fund options.

The reason for the underperformance of retail lifecycle products in relative to growth option is due to the mandate of the funds, i.e. to reduce the overall risk components by having a well-diversified portfolio. Compared to not-for-profits funds, which have a higher allocation to unlisted assets (on average 21% of the fund), the retail lifecycle products have 5% for these younger groups. Unlisted assets are proven assets that add value to fund over the long term.

The Road Ahead with Super Funds

As the uncertainty around the Covid-19 remains with fears of the second wave of infection and geopolitical crisis, extreme volatility in the markets will be a constant fear in the short term, affecting the superannuation balances.

However, such once a decade type of crisis creates both uncertainty and opportunity for members. Using the downturn as an opportunity, members can boost their superannuation savings fund by investing aggressively during this period.

Staying diversified also helps to survive such severe downturns and the overall impact is much less compared to the fund having exposure to high growth asset. For instance, the Australian Super’s Balanced option which has a well-diversified portfolio of growth assets, defensive assets like fixed income products, foreign currency, etc have only fallen by 6.45% in the March 2020 quarter, compared to the fall of 20.9% in the Australian market and 12.7% in the global markets.

But, for many industry experts, the real issue is not with the fall in returns due to Covid-19 induced economic slowdown. Rather, the Early Release Scheme, which has significantly undermined the purpose of superannuation by looking at it as a general emergency fund.

Also, concerns have been raised, whether the superannuation guarantee percentage of income can be lifted from its current level of 9.5% to 10% from July 1st, 2021. Intending to increase the superannuation guarantee percentage to 12% by 2025, the schedule has already seen a delay of seven years and once again will be under pressure due to lower wage rises.